As an electronics engineer working on control systems, I have had the opportunity to study a large number of physical processes, to develop models for their behaviour and to devise systems to control and/or to regulate them. I have always been interested in systems outside the domain of electronic / computerized control systems, and I have wanted to apply the techniques of modelling to other real life systems.

We have heard stories of warehouses catching fire, ships carrying cargo lost in storm, and how lucky the warehouse owner was because his warehouse was insured, or how unlucky the ship owner was because that particular ship was not insured. One of my friends headed an insurance company before retirement. During one of our chats he mentioned that insurance companies pay claims each year which were almost equal to the premium charged by them. I was surprised to learn that for government owned insurance companies, the claims paid were in excess of the premium earned.

How could a system take in less, and give out more, year after year, and why were so many privately owned insurance companies, whose motive is profit, entering the field of insurance, and thriving. This deserved some investigation and study. Something, on the face of it did not appear right.

The insurance business in India is regulated by the IRDAI (acronym for the Insurance Regulatory and Development Authority of India). I happened to read some excerpts of their annual report in the media.

I downloaded a copy of the IRDAI annual report to understand the figures better. For the private insurance businesses, the claims were 80.5%, operating expenses 18.3%, and the commissions paid 7% of the total premium collected. This meant a loss of 5.8%. Yet, the companies made a profit which was nearly 6% of the premium earned, and paid dividend to its shareholders which was 10% of the capital employed. How do these numbers work out this way?

We are all familiar with insurance. Every member pays a premium for a particular period, and if any member makes a claim, then it is paid back from the funds collected. The assumption is that all the claims for money are genuine, including the reason and the amount.

How is the premium decided? I started with the most basic model. Let the total premium earned be P, the number of members be M, the probability of a member making a claim be p and the amount claimed be A.

For the insurance mechanism to work: P > (p*M*A)

This basic model does not account for the fact that the process of insurance needs to be administered. Insurance providers may take steps to reduce or mitigate the insurance claims, plus efforts to sell the insurance packages, usually done on a commission basis. There is evidence of an insurance company, which used to provide Fire Insurance , setting up its own Fire Fighting service to reduce the extent of damage. Other mitigating measures include programs to inculcate safe driving or diagnostic tests to detect diseases early. The Company would also like to make a profit. If the administrative cost was ‘a’ , the selling costs ‘s’, the commission costs as ‘c’ of the premium earned, the earlier equation for the relationship between premium P and other variables could be expressed as

P >= (p*M*A) + a*P + s*P +c*P + annual profit

It turns out that the IRDAI places limits on how much the administrative and operating cost can be, as well as the maximum commission that can be paid to generate the business. In a particular instance, taking the premium earned as 100%, the claims were 80.5%, administrative costs 18.3%, commissions 7.2%, and the company made a profit of 6%. Plugging the figures into the equation looks like

100 >= 80.5 + 18.3 + 7.2 + 6 i.e. 100 >= 112 …What? How? There must be an explanation.

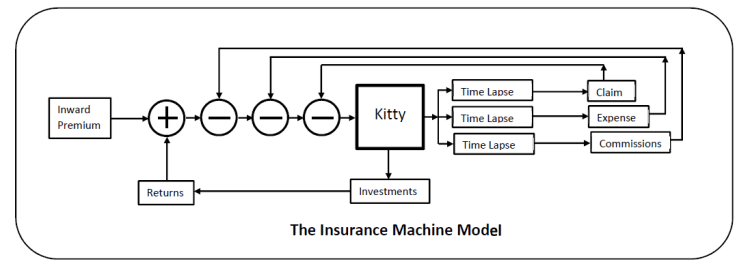

The explanation is this: Companies collect premium in advance, and claims are paid later. This creates a fund surplus with the Insurance Company, which promptly invests these funds. The amounts collected by the Companies as premium are very large and even modest returns on them are sufficient to generate the additional 12% that they require to balance the above equation.

The Companies have special conditions which discourage members from filing a claim. If no claim is filed by a member, (s)he is allowed a discount in the subsequent year. This ensures that small claims which are less than the discount will not get filed at all. There is also a cap on the maximum amount that may be claimed in a given year.

In the annual report, the investments made by Insurance companies were more than 20 times their annual premium. In a particular year, the total capital employed by a section of the Insurance companies was 11000 Cr, which allowed them to generate annual premium collection of 91000 Cr, make an investment of 200000 Cr, an annual profit of 6000 Cr, and distribute dividend of 1000 Cr. No wonder there are so many companies entering the field of Insurance.

It appears as if the Insurance business is more of a Financial Investment Business whose byproduct is Insurance. The reason people put in their money into insurance policies is part logical and part emotional. The questions I will leave you with are: In what are ways are Insurance companies appealing to our emotions? Where does buying insurance make logical sense? What are improved methods of modeling the various probabilities and perhaps even alternate models of insurance that can provide comparable benefits at a lower cost?